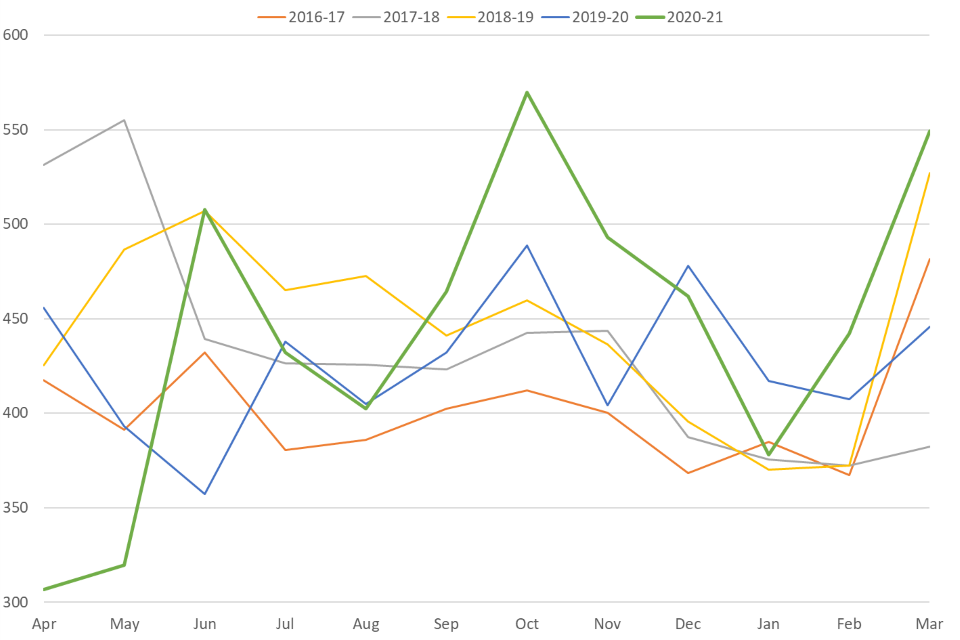

Inheritance tax receipts for the tax year 2020/21 saw an increase of £200 million from 2019/2020, reaching a total of £5.3 billion raised through this tax in this year.

It is interesting to see how the receipts fall month by month, as in the following graph from the Revenue, but the trend is definitely upwards.

As can be seen from the graph, the green line of 2020-21 is certainly pointing upwards and so it seems as if 2021-22 will be another bumper year for the Revenue.

Inheritance Tax remains as one of the most unpopular taxes we encounter, no doubt due to the feeling that it is another tax on money which has already suffered deduction.

There are many ways in which you can maximise your available exemptions and reliefs to ensure that you and your family are best-placed to minimise or manage any Inheritance Tax burden in future. For succession on tax planning, contact our specialist team today.

How can Tozers help?

For any further help or advice on anything covered in this insight, please contact our dedicated Later Life Planning team who will be happy to help.